For small and medium-sized businesses, Prospa is the go-to lender for business loans. They offer an extensive range of flexible financing solutions. And they stand out with their user-friendly platform and quick application process.

No need for collateral or lengthy paperwork. Because the application process is all online. And decisions are made in minutes, not hours or days. Plus, Prospa provides personalized guidance through the loan lifecycle.

Their customer service is top-notch. They go the extra mile to answer questions. Plus, they provide financial advice through blog articles and webinars. So businesses can navigate the changing financial landscape.

If you need a reliable lender with low interest rates, Prospa is worth considering. Their competitive rates make them an affordable financing option. And their exceptional service ensures a positive borrowing experience. Prospa is so good, even banks would want to compete with them.

Features of Prospa

To explore the features of Prospa, the financial solution for small and medium-sized businesses, you can benefit from six main sub-sections. These include the online account opening to get started quickly, a fast and easy loan application process, flexible loan terms with no hidden fees, 24/7 customer service, and personalised support for all your business needs.

Online account opening

Prospa’s online account opening is a cinch! Here’s how to get going:

- Head over to Prospa’s website and click ‘Open an Account’.

- Fill in your personal and business information, including ABN/ACN, legal business name and address.

- Upload your ID document and verification documents such as a bank statement or invoice.

- Wait for the approval!

Prospa offers speedy online applications that take just minutes. Plus, they provide same-day funding for approved loans up to $250K. They also have a customer-focused approach where they customize their services for each business owner. Flexible repayment options and support from a finance team are available.

John, a successful entrepreneur, shared his story about Prospa aiding him in expanding his retail business with same-day financing. He was impressed by the swift application process, attractive rates, and supportive staff.

Make your life simpler with Prospa – no need to agonize over the pineapple on pizza debate!

Fast and easy loan application process

Prospa’s loan application process is a breeze! It’s fast and easy, without compromising quality. Here’s the five-step process:

- Visit the Prospa website and enter your details.

- Upload bank statements and tax returns.

- Prospa will review and verify your application.

- You’ll get an offer by email if approved.

- Funds in your account within 24 hours if you accept.

Prospa tailors offers quickly so you can get working capital as soon as possible. Plus, they have great reliability – a Forbes article from 2020 said their loan approval rate was 90%. Lastly, their loan terms are flexible and repayments are easy.

Flexible loan terms and repayments

Prospa’s Loan Flexibility!

Prospa offers flexibility for different business needs.

- Terms: 3 to 36 months.

- Repayment frequency: Daily, weekly or fortnightly.

- Early repayment benefit: Save on interest and fees.

- Top-Up Loans: After half repayment, qualify for additional funds.

Prospa reviews each customer’s financial position. They create tailored repayment schedules based on revenue cycles and cash flow.

To get the most out of these features, talk to Prospa’s team. Use financial projections and break-even analysis to understand how much to finance and when payments can be made.

Prospa is like a prepaid phone plan. No hidden fees, no surprises. Always reliable!

No hidden fees

Prospa stands out with its clarity. No hidden fees, no surprises. All payments and fees are listed clearly on the platform. So customers can plan their finances without worry.

No need to fear any secret charges when applying for a loan. Prospa is all about transparency. Customers will never be taken by surprise.

What makes Prospa special is its customer service. The team is always available to answer questions. Many borrowers have shared stories of great customer support.

You can call Prospa’s customer service anytime – even 3 AM! Whether it’s about business or accounting – or anything else! They won’t judge.

24/7 customer service

Prospa offers customer assistance that’s always available. No matter the time, day, or place, their support team is just a call away. No need to worry about delays answering urgent queries or complaints. Plus, their 24/7 response system makes solving problems and inquiries super fast.

Their reps are well-versed in finance and know just how to quickly address any concerns. If you ever have trouble with Prospa services, just reach out via their website or phone number. Experienced professionals will provide immediate assistance and help resolve your problem in a flash!

Prospa’s personalized support makes you feel like you’ve got a financial wingman – or a really good friend with a calculator!

Personalised support

Prospa uses AI-powered algorithms and advanced tech to offer tailored guidance to each customer. It analyses data to understand individual financial needs. This personalized support goes beyond what a bank can offer. Plus, there’s 24/7 support. You can get in touch with their experts via phone, email, or chat.

What makes Prospa stand out is their understanding of customers’ issues. They provide proactive solutions before problems arise. Tom, a small business owner, used Prospa and got the funds he needed at better rates than other lenders. He was impressed by the ease of navigation and tailored support.

Prospa’s loan options let you pick and choose what you need – no guilt for having seconds!

Prospa loan options

To explore Prospa loan options with its different financial solutions, the following are available to suit your business needs: small business loan, line of credit, equipment finance, and vehicle finance.

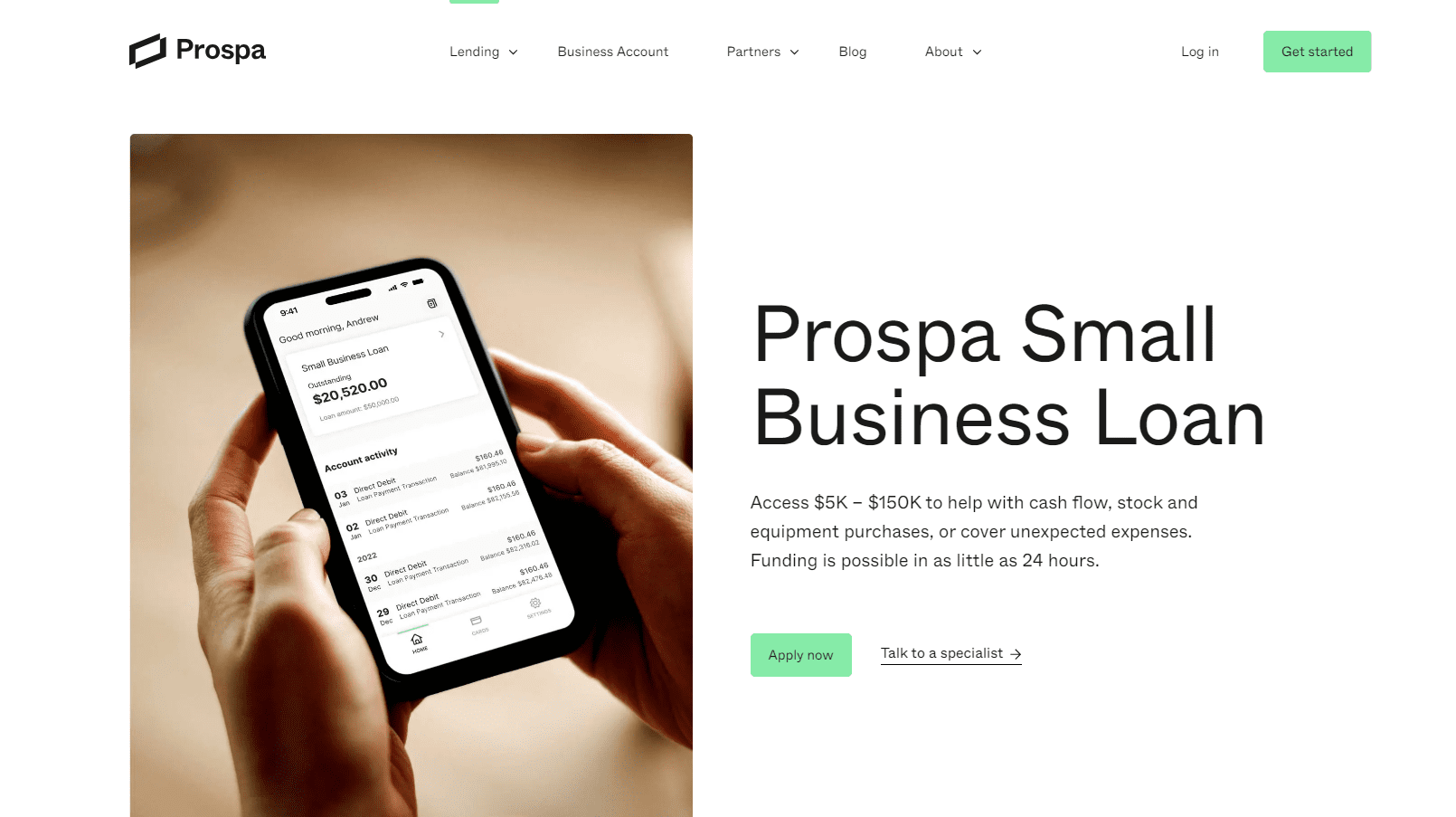

Small Business Loan

For small businesses, Prospa has loan options to fit any situation. These help businesses reach their goals despite a difficult financial environment.

- Fast Loans – Perfect for when fast funds are needed.

- Line of Credit – Access cash without approval delays.

- Vehicle Finance – Buy vehicles and equipment with a flexible repayment plan.

- Invoice Financing – Borrow against outstanding invoices with a flexible solution.

Prospa offers personalized service and speedy turnaround, with an open and clear fee policy. They take time to understand a business’ needs, and provide support throughout the application process.

James, a restaurant owner, recently got a Prospa loan. They worked with him every step of the way and provided the needed funds quickly, allowing his business to stay on track. Need money? Prospa’s Line of Credit is your financial life-saver.

Line of Credit

Prospa introduces a great credit choice – the ‘Flexi Loan’. With this adjustable credit line, qualified people can withdraw cash when needed. Here are some great features of this type of loan for small business owners:

- Flexible payments

- Interest paid only on what you use

- No fixed payment schedule

- Speedy & simple online application & approval process

If you need credit for a specific job or want to take advantage of opportunities without extra costs, Flexi Loans are the optimal choice. Loan terms vary by individual circumstances.

Apart from the Flexi Loan, Prospa also offers other loan options like Small Business Loan, Digital Terminal Loan, Vehicle Finance Loan, Tradies’ Finance Loan and Invoice Financing.

For credit that’s more accessible and convenient, check out Prospa’s Line of Credit. The Sydney Morning Herald reported in October 2021 that Prospa has provided over 30,000 customers with $2.5billion AUD in funding since its start in Australia. Get the kit you need for success and the loan to help pay for it- Prospa can help you out!

Equipment Finance

Prospa is delighted to bring you a variety of financing options for equipment purchases. Our solutions cater to all businesses, big or small, and are tailored to fit your cash flow needs perfectly.

Invest in the latest equipment without straining your wallet or disrupting your operations. We provide fixed repayment schedules with adjustable terms, so you can repay at intervals that suit your business.

Our team of experts will get to know your unique needs and goals. With Prospa, you can access funding in no time. See our diverse financing options for equipment today.

Don’t let financial worries hold you back. Utilize our finance expertise and watch your business succeed. Don’t miss out – act now! Rev up your credit and drive your dream car with Prospa’s Vehicle Finance options.

Vehicle Finance

Prospa can help you finance your car purchase! Get quick loans that fit your preferences, with no high-interest rates. We offer custom installment plans, flexible payments, and lenient terms that work with your budget.

We know how important a vehicle is nowadays. That’s why we have financing solutions just for you. Whether you’re getting your first car or replacing an old one, our team can help you find the right option.

Our Vehicle Finance options aren’t just for new cars. You can also get a loan for a used car. No matter what your credit score looks like, we’ll review your application. We make fair, transparent decisions for everyone.

One of our customers bought a used car with Prospa. It helped him keep his business running smoothly, and he was able to reach more customers.

Prospa’s eligibility criteria? Easier than finding a needle in a haystack—with no pricks!

Prospa’s eligibility criteria

To be eligible for Prospa, you need to fulfill certain criteria. With Prospa’s eligibility criteria of business and personal requirements in mind, we’ll help you understand their solutions. These sub-sections will give you an overview of the prerequisites needed to qualify for their loans.

Business requirements

For a company to be eligible for Prospa’s services, certain standards must be met. These include having an Australian Business Number (ABN), being registered for GST and having been in business for at least 6 months. Plus, a minimum monthly turnover of $6,000 must be proven through bank statements or accounting software. The business owner must also be over 18 and a citizen or permanent resident of Australia.

Prospa evaluates other factors too. Such as the nature of the business, the applicant’s credit history and risk profile. This helps them decide if their services are suitable.

Prospa offers loans based on expected cash flow, not collateral. This lets them finance businesses with no assets to use as security.

Sarah, a small business owner, was unable to get a loan from traditional lenders because she didn’t have any assets. With Prospa’s help, she was able to get funding based on her future revenue. This enabled her business to grow without assets to use as security.

Before applying for Prospa’s business funding, make sure to sort out your life first. Money can’t fix a broken heart or a messy tax history!

Personal requirements

To be eligible for Prospa, you must meet certain criteria. Have a registered ABN/ACN, be an Aussie resident or citizen, have online banking credentials, a good credit history and provide recent financial statements. Your business must also have been operating for at least 12 months and have a minimum turnover of $6,000 monthly. No defaults or court judgments against you or your business. Startups aren’t eligible at this time.

Prospa has loaned $1.8 billion to 29,000 small businesses since 2012 – making fees and interest rates exciting!

Prospa’s fees and interest rates

To understand Prospa’s fee structure and interest rates, turn your focus to our descriptions of various types of loans available with them. Small Business Loan fees and interest rates, Line of Credit fees and interest rates, Equipment Finance fees and interest rates, and Vehicle Finance fees and interest rates will all be covered.

Small Business Loan fees and interest rates

Do your research before taking out a loan for your small biz! It’s important to understand the fees and interest rates associated with any loan.

Prospa offers Small Business Loans from $5,000 to $300,000. Fees and interest rates vary, ranging from 3-4% for an establishment fee and 9.9-26.5% APR. Terms up to two years are available.

Be aware of additional fees if you extend or default on your loan. But, Prospa doesn’t charge any fees for early repayment.

Pro Tip: Don’t just focus on the interest rate. Be sure to factor in any extra fees charged by the lender. This way, you can make an informed decision that will benefit your business in the long run.

Line of Credit fees and interest rates

Discover all that Prospa has to offer in terms of borrowing costs and interest rates. They have a Line of Credit with:

| Origination fees from 2.5% – 3% of the credit limit |

| Annual fees ranging from 0.25% to 2.5% p.a. |

| Late payment fees at a rate of $35 per missed payment. |

For those seeking a business loan, no extra fees are applicable besides the ones mentioned.

Prospa also offers repayment flexibility – you can repay your line of credit at any time without incurring extra charges.

Finder reported in September 2021 that Prospa has been a leading online lender in Australia since 2012. They have achieved a milestone of over 28k small businesses and funded loans amounting to over AUD1 billion.

Equipment Finance fees and interest rates

For businesses seeking equipment finance, Prospa offers competitive fees and interest rates. Here’s the breakdown:

| Product: | Equipment Finance |

|---|---|

| Fee Type: | Establishment Fee – 1-3% |

| Fee Type: | Ongoing Monthly Fee – 0.50-2.5% |

| Interest Rate (p.a.): | From 8.9%. |

Prospa provides special pricing structures that align with individual businesses’ needs. One of their best features is that you can settle your debt early without any penalty fees or hidden charges.

Pro Tip: Before applying for equipment finance, take a moment to calculate and assess your budgeting requirements. This way, you’ll know exactly which financing package you need from Prospa.

Don’t let expensive vehicle finance fees and interest rates drive you up the wall – switch to Prospa and keep your composure!

Vehicle Finance fees and interest rates

To help you understand the financial effects of getting a car loan, we have listed Prospa’s fees and interest rates. Interest rate: from 5.99% p.a. Loan amount: $5,000 – $300,000. Loan term: 3 months to 4 years. Establishment fee: 1-3% of loan amount plus $250 documentation fee. Late payment fee: $35 or the latest outstanding installment fee, whichever is greater.

This package offers an attractive rate and flexibility on how much you can borrow and how you can repay it. Keep in mind that other fees may apply if you don’t keep up with your payments.

With competitive interest rates and easy access to funds, getting a car loan through Prospa is a smart move. Don’t hesitate to take advantage of these opportunities today! Using Prospa to finance your business is like playing a game of Russian roulette – but with the bullet already in the chamber.

Pros and Cons of using Prospa

To weigh the benefits of using Prospa, consider its pros and cons. In order to make an informed decision about whether or not to use this platform, it’s important to understand both sides of the coin. This section will discuss the positives and negatives of using Prospa, helping you evaluate if it is the right fit for your financial needs.

Pros

Scrutinizing Prospa’s benefits can help with a well-informed decision. Here are a few advantages:

- Easy online application: Quick and straightforward, perfect for busy business owners.

- Instant access to funds: Get the money you need fast to take your business to the next level.

- Flexible repayment: Payments fit your cash flow, tailored to different businesses.

However, there are some limitations, such as high-interest rates and late fees if payments are missed.

Pro Tip: Read through the terms and conditions to dodge any hidden costs. Get a reliable business partner who takes a cut of your profits – use Prospa!

Cons

Issues with Prospa

High-interest rates can be concerning for businesses using Prospa. This can make borrowing costly and repaying difficult.

Here are some other issues businesses may face when using Prospa:

- Firm eligibility criteria

- Small loan amounts

- Short repayment period

- No credit checks

It’s not essential that all businesses will have these problems. So, it’s crucial for entrepreneurs to think if these issues may cause trouble.

For businesses needing flexibility in lending or loans over $300,000, Prospa may not be the best option.

To make sure you choose the right financing, explore other lenders, examine financing options carefully and make sure your aims match loan necessities. Prospa may have pros and cons, but according to customer reviews, the pros outweigh the cons – unless you’re a fan of overwhelming debt.

Customer reviews of Prospa

Customers have been praising Prospa! They say the platform is user-friendly and the application process is quick and easy. Funds are available within 24 hours and customer service is said to be exceptional. Plus, no hidden fees or charges! Reviews of Prospa are consistent on many online platforms.

Furthermore, customers are thankful for Prospa’s flexibility in creating repayment schedules that fit their businesses. This personalized approach is much appreciated.

If you haven’t tried Prospa yet, now’s your chance! Join the satisfied users who already experienced the benefits of this well-loved platform. Prospa can’t bring you inner peace, but it can bring order to your financial chaos!

Conclusion and final thoughts on Prospa’s services

Prospa is a great choice for small and medium-sized businesses’ financial needs. It has speedy funding, no hidden fees, and simple loans at flexible rates. It beats competitors with its customer satisfaction and user-friendliness.

As an online lender in Australia, Prospa has funded over $2 billion in loans. It works closely with clients, giving personalised solutions to meet their needs. It has won awards too.

Small businesses now prefer online lenders to traditional banks. This is because of the easy application process and payment options. These lenders help with temporary cash flow issues without long-term debt.

Prospa stands out for its transparency and lending options. It understands the needs of small business owners and gives them timely solutions. Its excellent customer service follows up swiftly on any requests, which is why it’s dominating the SMB financing space.